The Main Principles Of Hsmb Advisory Llc

Bureau of Labor Data, both partners functioned and generated earnings in 48. 9% of married-couple households in 2022. This is up from 46. 8% in 2021. They would be most likely to experience monetary hardship as an outcome of one of their breadwinner' deaths. Medical insurance can be acquired with your company, the government medical insurance market, or exclusive insurance policy you purchase for on your own and your family by contacting health insurance coverage firms straight or experiencing a medical insurance representative.

2% of the American population was without insurance policy coverage in 2021, the Centers for Disease Control (CDC) reported in its National Center for Wellness Stats. Greater than 60% got their coverage through a company or in the private insurance coverage industry while the rest were covered by government-subsidized programs consisting of Medicare and Medicaid, experts' benefits programs, and the federal industry developed under the Affordable Treatment Act.

The Only Guide for Hsmb Advisory Llc

If your revenue is reduced, you may be one of the 80 million Americans that are qualified for Medicaid. If your earnings is moderate but does not extend to insurance policy coverage, you may be qualified for subsidized coverage under the government Affordable Care Act. The best and least pricey alternative for employed staff members is generally joining your company's insurance policy program if your company has one.

According to the Social Security Administration, one in 4 workers getting in the workforce will certainly become disabled prior to they get to the age of retirement. While health and wellness insurance coverage pays for a hospital stay and clinical expenses, you are typically burdened with all of the expenditures that your paycheck had covered.

Before you purchase, check out the small print. Numerous strategies call for a three-month waiting period before the protection starts, provide a maximum of three years' well worth of protection, and have substantial policy exclusions. Regardless of years of enhancements in car security, an approximated 31,785 people died in web traffic accidents on U.S.

Unknown Facts About Hsmb Advisory Llc

Comprehensive insurance covers theft and damage to your car due to floodings, hailstorm, fire, vandalism, falling objects, and pet strikes. When you finance your automobile or rent a vehicle, this type of insurance policy is mandatory. Uninsured/underinsured motorist (UM) protection: If an uninsured or underinsured driver strikes your car, this coverage spends for you and your traveler's clinical expenses and may additionally make up lost revenue or compensate for pain and suffering.

Employer insurance coverage is typically the why not try these out most effective choice, but if that is not available, obtain quotes from numerous service providers as numerous provide discounts if you acquire greater than one kind of protection. (https://hsmbadvisory.start.page)

A Biased View of Hsmb Advisory Llc

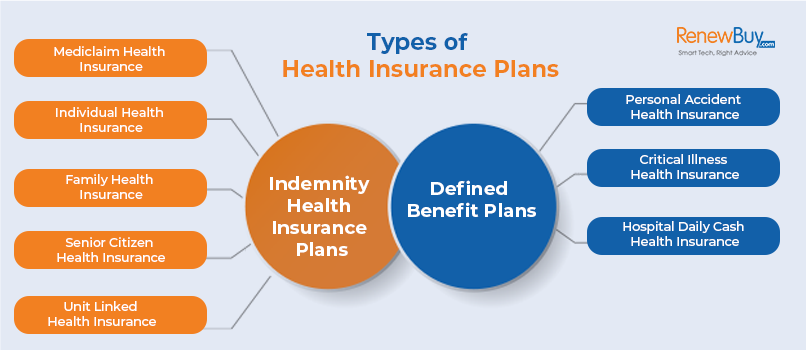

Between health insurance coverage, life insurance policy, disability, liability, lasting, and also laptop insurance coverage, the task of covering yourselfand considering the endless possibilities of what can happen in lifecan really feel overwhelming. Once you recognize the basics and make certain you're effectively covered, insurance can boost monetary self-confidence and wellness. Here are one of the most crucial sorts of insurance policy you require and what they do, plus a pair pointers to prevent overinsuring.

Different states have different guidelines, yet you can anticipate health insurance policy (which many individuals get via their company), auto insurance (if you own or drive an automobile), and home owners insurance coverage (if you possess building) to be on the listing (https://pubhtml5.com/homepage/cwkrs/). Mandatory kinds of insurance can alter, so check out the current legislations periodically, particularly before you restore your plans